Since the very beginning of community banking, these home-grown institutions have enjoyed a d...

Read More

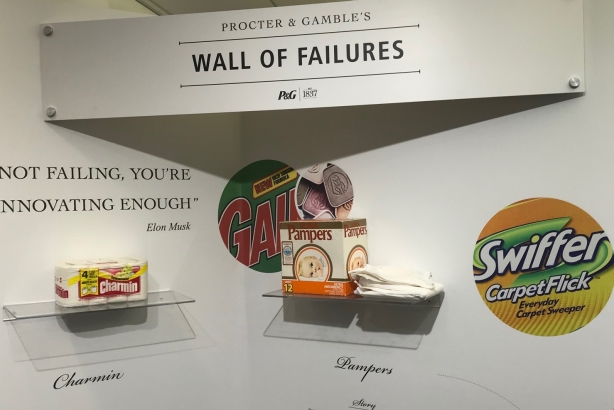

Ad agency folks are famous for their metaphors. When we came up with a campaign idea, for instance,...

Read More

Photo courtesy of PR Week Magazine

I’m somewhat ashamed to say this, since I’m suc...

Read More

Back in the first week of January, President Biden picked Sarah Bloom Raskin to be the Federal Reser...

Read More