April is Financial Literacy Month. Why is that important to banks? When most folks hear the ph...

Read More

Well, this isn’t the first time we’ve talked about the benefits of social media marketin...

Read More

As a community bank in what is at the moment, challenging times, you’re no doubt getting the &...

Read More

The second-biggest bank failure in U.S. history is raising concerns about whether other bank...

Read More

Sustainability. To most, the word connotes “going green” by choosing paper over plastic,...

Read More

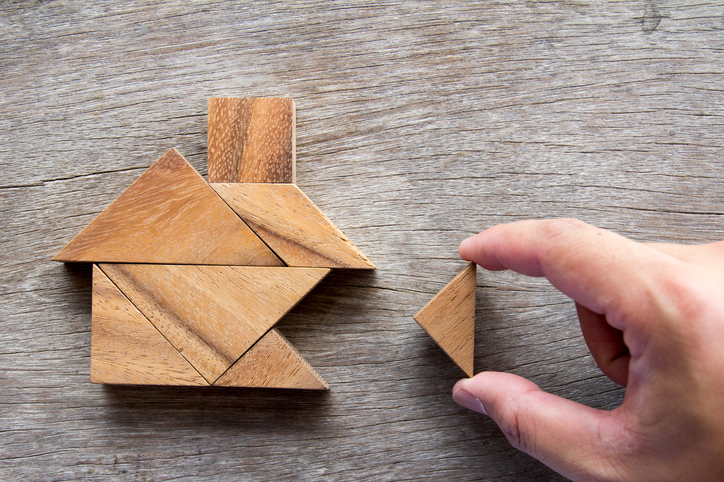

Triangles are the building blocks on which solid marketing is founded. Why are triangles important t...

Read More