As a community bank in what is at the moment, challenging times, you’re no doubt getting the “marketing word” out there via social media, right? Good. Social media marketing has been proven to be pretty effective and easy to both implement and gauge effectiveness.

I’m guessing that much of your social media marketing is designed to yield site visits. After all, social media marketing is a great way to drive traffic to your website and take that potential customer further along your “buyer journey”, that is, from “awareness” to “consideration” to “decision making.”

I’m guessing, too, that you’re watching your site traffic, as well, watching your number of visits, pages visited, length of stay, etc. These KPIs (key performance indicators) are hugely helpful in understanding not only what a visitor does during their site visit, but also in providing insights into WHY they do what they do once there.

Of course, as you know, unfortunately, you’ll have quite a few visitors who stop by and then simply leave; no additional pages visited, no actions whatsoever taken. These are individuals who have, let’s face it, shown some interest in your products and services. After all, they wouldn’t have taken the time to visit your site if they weren’t, right? So, what do you do with this knowledge?

To use the retail store analogy, a potential customer enters your shop. They do a bit of browsing, then start heading for the door? What do you do? Simply let them walk out? No, you attempt to engage them before they leave, perhaps with a question like “can I help you?” or “are you looking for something in particular?”

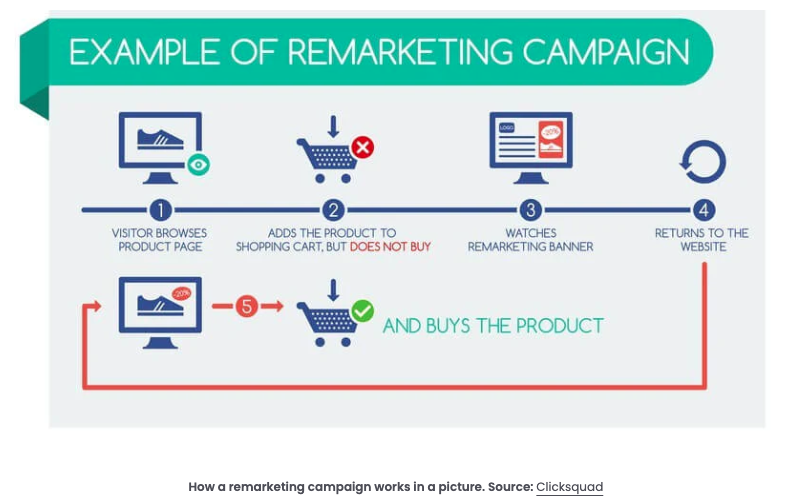

Approaching that potential customer “as they head for the door,” and attempting to engage them is what is known in the digital marketing world as “remarketing.” Think of it as getting a second chance to win that customer.

Remarketing is a tactic that involves showing ads to people who have visited your website or used your mobile app. This strategy is a particularly cost-effective way to increase your sales conversions because you’re reaching out to individuals who have already expressed interest in your products or services.

How does digital remarketing work? It starts with “pixels” or “tags,” which are basically pieces of code. To target previous website visitors with remarketing ads, you need to insert that code in the back end of your website.

When someone visits your site, that pixel is placed on their browser, attaching a “cookie” to it. When the visitor leaves your site to surf the web and visit other sites, that cookie notifies retargeting platforms to serve specific ads based on the specific pages they visited on your website. Say, the visitor perused your page that spoke to the benefits of opening a HELOC. That visitor leaves your site and visits a site that sells, say, home improvement products. Thanks to the cookie, you can now place an ad on that home improvement site that encourages that visitor to learn more about your HELOC, with a link that will take them directly back to that page on your site.

You have other options, too. If a visitor does get a HELOC, and you’re interested in perhaps cross-promoting another product, such as a credit card, you could create an ad that targets them. Start by configuring your remarketing campaigns across various social networks as that’s where your possible target audience would be. Through remarketing, combined with customer purchase behavior data, you can re-engage a purchaser while they’re surfing the web. And, with an ad that targets that individual specifically; an ad, for example, that focuses on the benefits of your credit card. It’s all possible due to the magic of pixels!

Is remarketing effective? The numbers tell the story. Statistics show that people are 10 times more likely to click on a remarketing ad than a standard display ad, while some campaigns have reported a 128% increase in conversion rates through remarketing. Who says there’s no such thing as a second chance at winning over a customer? Remarketing is a relatively simple and cost-effective way to get that second chance.

About Bank Marketing Center

Here at bankmarketingcenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. In short, build your brand.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts on the subject.