Admittedly, I haven’t come across formal research that directly links platforms like FanDuel o...

Read More

The message coming out of the 2025 Small Business Banking Conference was clear: small busines...

Read More

You’ve probably heard of Bitcoin or Ethereum; they live in this wild world wher...

Read More

What is a content approval gap? It’s the lack of a clear, documented process for stakeholder r...

Read More

Remember when the U.S. Postal Service floated the idea of getting into the banking business? Now it&...

Read More

For many marketers – even experienced ones – Search Engine Optimization (SEO) can seem l...

Read More

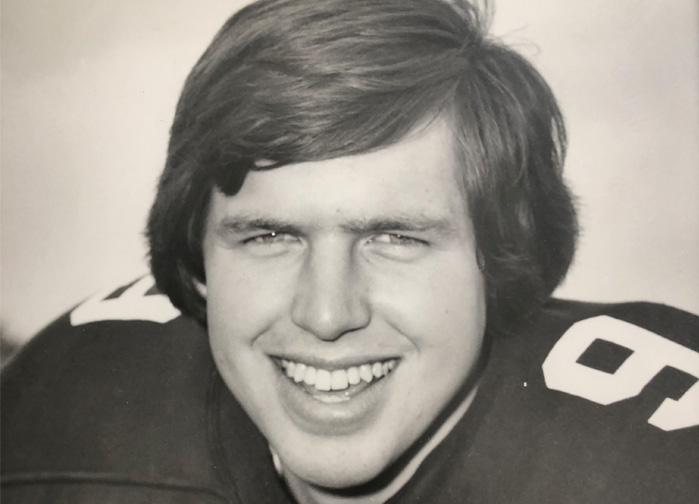

Sports teams, sports venues, and individual athletes are hot commodities these days, ar...

Read More

Upon reading some recent articles about how banking behemoths like BofA and Chase are &ldquo...

Read More

Ah, the whacky, wonderful, and often confusing world of social media marketing! What’s...

Read More

When natural disasters like Helene and Milton strike, the aftermath is inevitably devastating to ind...

Read More