Federal Reserve Chair Jerome H. Powell warned on Tuesday that “the economic road ahead remains long and uncertain with 20 million jobs lost since February, an unemployment rate at the highest level since the Great Depression, and $6.5 trillion in household wealth gone in the first quarter.” The irony here? While more than one in five workers has filed for unemployment, an historic number of individuals, individuals ranging from millennials to the greatest generation, are shelling out upwards of $500,000 for the opportunity to travel that “long and uncertain economic road” in a luxury motor home.

Evidently, Jerome isn’t experiencing the same wanderlust that seems to be driving millions of Americans – roughly 46 million according to surveys – to hit our nation’s highways, byways, 13,000 private RV parks, and estimated 1.23 million individual trailer campgrounds. It seems that the “road to recovery” is one that many Americans are looking to travel, quite literally… in style.

According to recent research examining consumer interest in Covid-19 travel conducted by data supplier Ipsos, “RV travel and camping is now providing an exponentially appealing vacation option for American families. 46 million Americans plan to take an RV trip in the next 12 months.” Their first stop of their journey? It should be their community bank, in search of financing.

According to RV Industry Association, RV sales in some areas have sped up 170 percent over the same time period last year. Driving some of the sales gains are:

- a financial lift from stimulus money

- the onset of warmer weather

- the need for some sort of vacation break

- a move toward early retirement

- the opportunities presented by virtual employment

- the belief that a personal vehicle (especially one with heated floors, an entertainment system, and multiple bathrooms) is an extremely appealing way to social distance/quarantine, and

- a cautious optimism from some that the worst of the pandemic could be over.

Banks are seeing the opportunity to make both secured vehicle loans and unsecured personal loans as this market gathers speed. Do a Google search of the phrase “RV loan” and you’ll see that many banks and non-banks are getting on board the RV bandwagon, spending to stay at the top of an organic search page ranking; USAA, Lightstream/Truist, Lendingtree, and Nerdwallet to name just a few. Many have either added or enhanced existing RV information-dedicated pages to their websites, such as SunTrust’s “RV Trends,” extolling the virtues of RVs, recreational vehicle features, and the benefits of the lifestyle that comes with an RV purchase. Below is a snapshot of rates, terms and minimums from five banks offering RV financing as of May 13.

Most RV loans feature repayment terms that range between 10 and 15 years. However, some lenders offer RV loans that stretch out as long as 20 years. There are affordable RVs available today for under $10,000, but the average price of a motor home is much higher, anywhere from $100,000 to $150,000.

These RV loans can generate a fair bit of interest income for lenders. According to 2017 data gathered by thewanderingrv.com – and remember, these numbers were compiled well before the recent spike in sales – “over 200,000 indirect loans were generated at retail locations offering recreational vehicles. These loans totaled $8.4 billion from households purchasing RVs.”

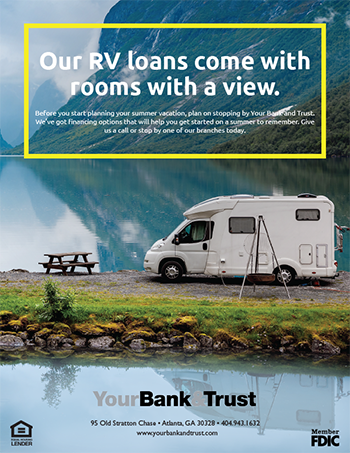

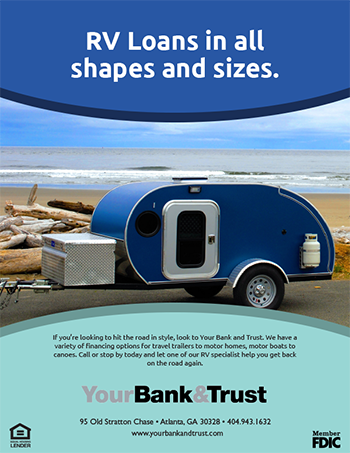

Here at BankMarketingCenter.com, our goal is to help you with that vital, topical, and compelling communication with customers, including ads focused on enhancing your loan portfolio through recreational vehicle financing. Here are just a few samples:

To see more of our work, both print and digital, visit bankmarketingcenter.com. Or, you can contact me directly by phone at 678-528-6688 or email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.