At least, that’s what he would like you to believe.

October is Cybersecurity Awareness Month, a time to remind ourselves that, unfortunately, cybercrime is on the rise. The last six months have brought an exponential increase in fraud and scams… in particular, crimes that involve financial institutions. Every day, in fact, thousands of bank customers are targeted by scammers posing as bank employees, hoping to steal their personal information, then, their money.

Since March, regulatory agencies have been flooded with complaints about suspected scams. According to the Federal Trade Commission, consumers reported losing more than $1.9 billion to fraud in 2019, with nearly $667 million lost to imposter scams alone. “While scammers target consumers using every possible method of communication, phone calls were the most common,” the agency states.

Considering that the $1.9 billion loss was reported prior to the economic downturn, that approximately 15% of cases go unreported, and that the last six months has seen an exponential growth in the use of online banking tools, the fraud loss for 2020 will undoubtedly be considerably higher.

A bit of history. Cybersecurity Awareness Month was launched by the National Cyber Security Alliance (NCSA) and the U.S. Department of Homeland Security (DHS) in October 2004 in an effort to help Americans stay safer and more secure online.

When Cybersecurity Awareness Month first began, those awareness efforts centered around advice like updating your antivirus software twice a year to mirror similar efforts around changing batteries in smoke alarms. Much has changed since then. Cybersecurity Awareness Month has “grown significantly,” according to the National Cybersecurity Alliance “in reach and participation. Operated in many respects as a grassroots campaign, the month’s effort has grown to include the participation of a multitude of industry participants that engage their customers, employees and the general public in awareness, as well college campuses, nonprofits, and other groups.”

One participant that has really ratcheted up its participation? The federal government. Federal agencies are now paying real attention – and justifiably so – to cybercrime. Valuable guidelines and resources can be found on federal agency websites such as usa.gov, the US Department of Justice, and the Federal Trade Commission. These sites go into great detail, describing the various types of cybercrimes and what action individuals can take to protect themselves.

As their financial institution, it’s imperative that your customers know that their personal information, and their money, is well protected. Remember, too, that your customers aren’t the only ones who suffer. Banks like yours face significant monetary and reputational losses from these increasingly sophisticated scams targeting your customers.

About Bank Marketing Center

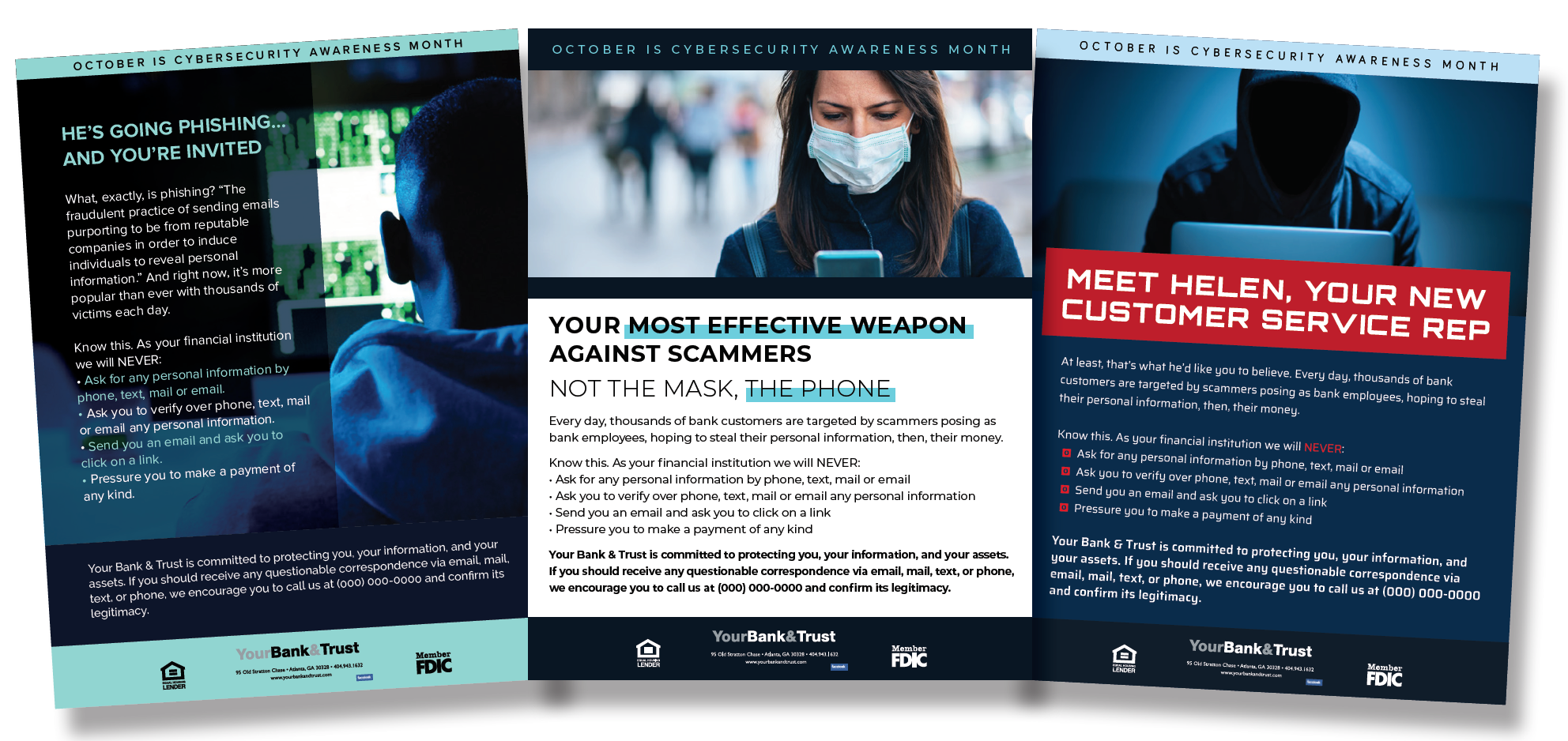

Here at BankMarketingCenter.com, our goal is to help you with that vital, topical, and compelling communication with customers; messaging that will help you build trust, relationships, and with them, your brand. Visit our site now to view our new campaign addressing cybersecurity, which you can customize and put in front of your customers in just minutes. Here are just a few examples of the new creative:

To view our marketing creative, both print and digital – ranging from product and brand ads to in-branch brochures and signage – visit bankmarketingcenter.com. Or, you can contact me directly by phone at 678-528-6688 or email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.