At one time — and it wasn’t that long ago, it seems — small banks worried that they’d lose their customers to the larger, national banks. But that’s not the case anymore. For small banks, the threat of losing customers, both commercial and retail, is coming in the form of a two-pronged attack; from the large nationals on one front, and from digital banks and fintechs on the other.

According to a recent Forbes article, “The growing domination of Chime, Cash App, and PayPal in Banking,” a Capstone Advisors study reveals that Americans are moving their primary accounts, i.e., checking, from traditional banks to digital banks and fintechs, such as Chime, PayPal, and Square. “More than a quarter of Gen Zers (21 to 26 years old) and nearly a third of Millennials (27 to 41) now call a digital bank their primary checking account provider. Meanwhile, Arizent recently conducted a survey of small-business stakeholders in a variety of industries that had, on average, 129 employees and revenues of approximately $8 million. What they learned about commercial customers was very much in line with what Capstone Advisors learned about retail customers: Roughly half of the small businesses surveyed said that they use more than one banking services provider on a regular basis.

There’s good news and bad news.

This, of course, gives providers such as community banks the opportunity, with a foot already in the door with their customer, to build on that relationship. That’s the good news. The bad news is that their competitors, such as the digital banks their customers are also using, have the same opportunity.

This is what I found most interesting about the Arizent study. While both small business customers and individuals do indeed want more personal interaction, they're happy to have that interaction take place via online chat, video, or phone. Charles Potts, Chief Innovation Officer at the Independent Community Bankers of America, had this to say in the Forbes article. “Many consumers need a banker, not just a bank—and the relationship banking model is at the heart of community banking.” Interestingly, according to the Arizent survey, that relationship no longer hinges on meeting bank personnel in branches. Consumers can “meet” their bank in a variety of ways, anytime, and from virtually (no pun intended) anywhere.

Thanks to our digital transformation in customer service, it seems, today’s banking customer is just as happy (perhaps, in some cases, even happier!) to converse with a chatbot as they are a real person. This is further supported by a recent report from digital services firm, westmonroe: “73% of respondents to our customer survey said a completely digital experience would improve their banking experience. Our survey confirmed that while banks might be meeting basic digital needs, customer expectations have already moved on from basic functionality to next generation digital experiences.”

Of course, banks need to continually upgrade their digital banking experience. For me, and from a marketing perspective, here’s a great case for social media and its power to personalize. Yes, for community banks their USP (Unique Selling Proposition) has always been personal service, relationship building, and connection to community. That hasn’t changed. But, something else is changing; it’s the attitude consumers have toward digital experiences.

So, what’s a small bank to do?

Focus on your social media marketing. We now have a myriad number of ways to interact with consumers, socially, and since consumers are increasingly comfortable with social media as a personal interaction, small banks need to take full advantage of social media marketing. The 9-5 way of doing business is gone. Consumers expect information at their fingertips 24/7/365. Thanks to social media, banking customers and their community bank can now communicate all day, every day… through posts, webinars, infographics, ebooks, videos, and more. That communication isn’t simply about products and services, either. It’s about what’s happening in the local community, about the commitment of their employees, the organizations the bank supports, and more… in short, the kind of conversations that digital banks and the big nationals simply can’t have with their customers. And, it’s not pushed on consumers but, instead, it’s offered to them. They choose when they want it, and in what form.

So, can smaller banks find a place where only they can go, one that is safe from the threats posed by the nationals and the Chimes of the world? Absolutely. And social media will take them there.

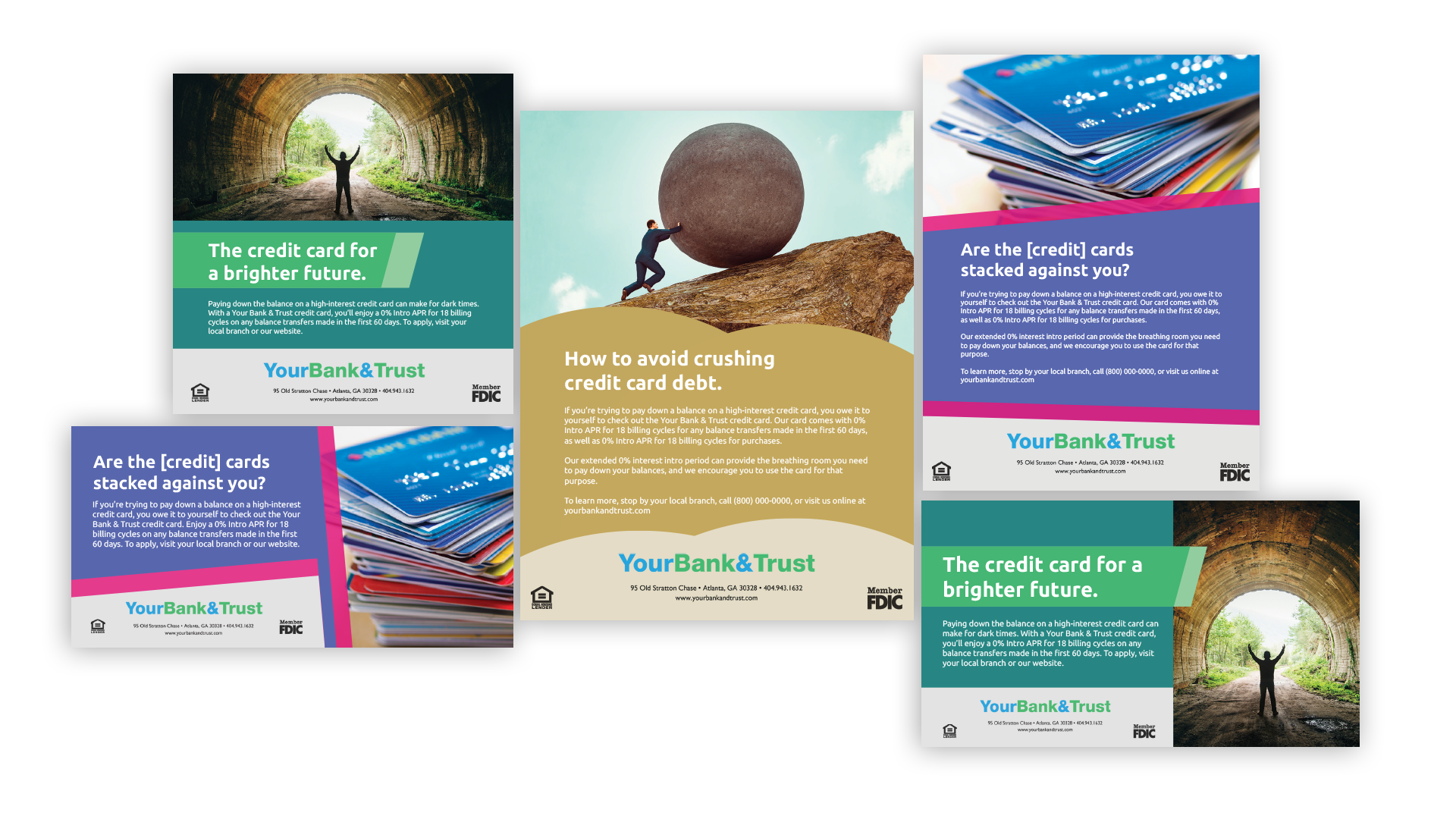

About Bank Marketing Center

Here at BankMarketingCenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. In short, build your brand. Like these balance transfer card campaigns, for instance, which you'll find in our portal and will help you get the message out to your customers quickly and easily.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject. #bankmarketing #communitybankmarketing #socialmediamarketing