Marketing automation in banking is about more than just streamlining repetitive tasks—...

Read More

It’s once again that most wonderful time of the year! Or, is it? Despite the 24/7 pred...

Read More

When it comes to marketing, community banks face unique challenges. For starters, unlike larg...

Read More

As a business owner who works with banks and relies heavily on technology, I read Steve Morgan's rec...

Read More

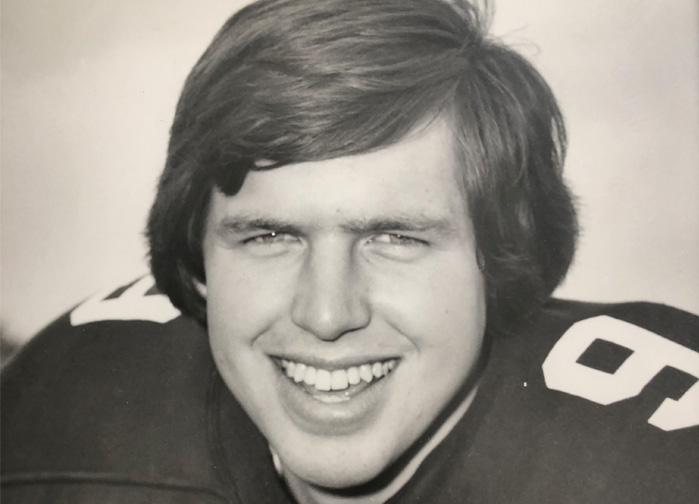

Sports teams, sports venues, and individual athletes are hot commodities these days, ar...

Read More

The latest deadline for the Farm Bill passed unceremoniously – and seemingly, unnoticed by man...

Read More

Upon reading some recent articles about how banking behemoths like BofA and Chase are &ldquo...

Read More

Ah, the whacky, wonderful, and often confusing world of social media marketing! What’s...

Read More

When natural disasters like Helene and Milton strike, the aftermath is inevitably devastating to ind...

Read More

Small business is big news again. As reported by American Banker in their recent article, Gruenberg...

Read More