Today’s banking consumers aren’t simply making decisions on products and services; they&...

Read More

Let's run it up the flagpole and see who salutes it.”

“Let’s put it...

Read More

Strong brand guidelines mean better recognition and credibility for your bank. Discover how to create yours now!...

Read More

I’ve said this before, and I’ll say it again: I’m not an economist. While I...

Read More

Let me take you back, briefly, to my early days in “the business,” that being the advert...

Read More

What do bananas and baking soda have to do with bank marketing? I thought you would never ask. Let&r...

Read More

Since the very beginning of community banking, these home-grown institutions have enjoyed a d...

Read More

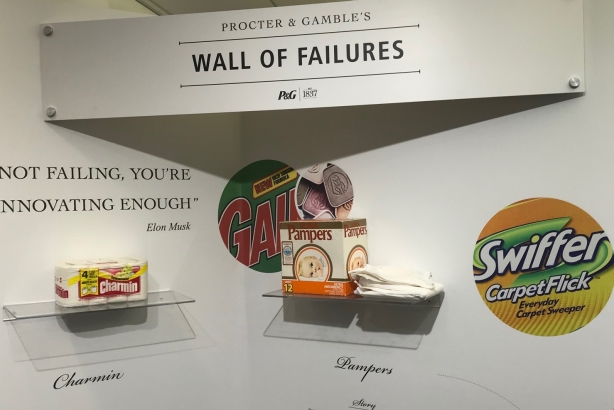

Ad agency folks are famous for their metaphors. When we came up with a campaign idea, for instance,...

Read More

Photo courtesy of PR Week Magazine

I’m somewhat ashamed to say this, since I’m suc...

Read More

In our last blog, we talked a bit about marketing messaging; some of the art and science that goes i...

Read More