I just recently read somewhere that if you’re a community bank and it takes a customer more than 3 minutes to open a retail deposit account or apply for a loan, then you’re losing that customer to challenger banks and money-center banks.

Of course, this way of thinking has been with us for years now. The “digital transformation” and how critical it is to the community bank’s survival is in the news daily, with bankers being constantly reminded that it they fail to offer a totally automated, lightning-fast online banking experience that they’ll surely find themselves on some substandard-digital-banking-experience scrap heap. Is this really where community banks should go? I mean, doesn’t this very notion of fully automated services, such as an under-three-minute account open or loan application process, fly in the very face of what community banking is all about?

Now, that’s not to say that community banks should ignore the data and rely totally on in-branch services. Of course, that doesn’t make any sense. But can a community bank remain a true community bank by encouraging people to rely more on automation and less on personal interaction?

American Banker’s February article, “5 trends sweeping digital banking now,’ provided us with some helpful charts and graphs so that we might better understand where banking is going in the digital age.

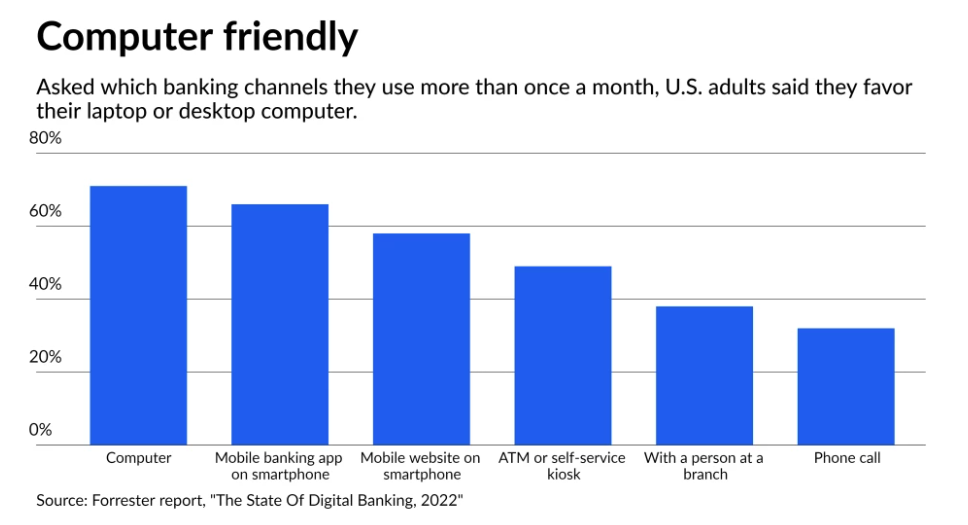

According to a Forrester report, adults surveyed said that they would much rather do their banking on their laptop or phone than visit with a person at a branch. Okay, I can accept that; we’ve been heading this way for a while.

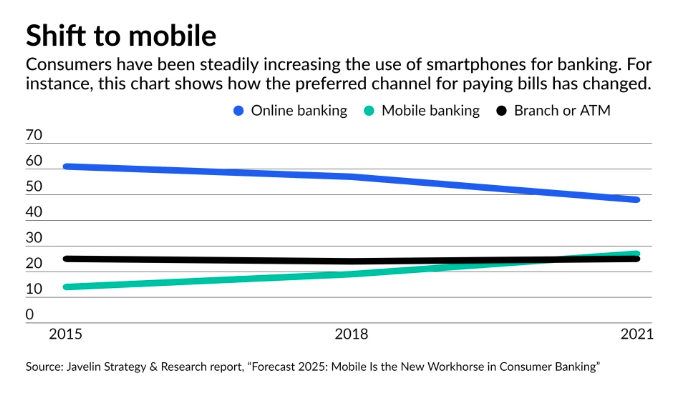

Now, according to the above graph courtesy of Javelin, while adults would rather bank on their laptop or phone instead of in a branch, online banking is becoming a bit less popular — and mobile banking more popular — “as Gen Z consumers enter adulthood and reach for their smartphones for financial matters.” The American Banker article then goes onto say that while banking on phones is becoming more popular, the majority of people leave bank websites after looking at one page on their phone. “For bank customers, such a quick bounce would suggest a failed login, perhaps due to forgetting a password. To Mark Schwanhausser, Director of Digital Banking at Javelin, this data shows that banks need to put more effort into their mobile websites. Banks have done a good job making their websites and mobile apps useful for common banking chores, like monitoring balances and reviewing transactions. The next big challenge is to figure out how to make apps the go-to channel for financial matters that require more thought.”

Now, is that really a good idea for community banks? Don’t they already have a “go-to channel for financial matters that require more thought?” I believe it’s called a branch. Instead of trying to do a better job of distancing themselves from potential and existing customers by offering a “get-approved-in-less-than-3-minutes loan application, I think a better strategy might be to focus on the fact that they DON’T offer that kind of service. What happens to the community bank that does, in fact, leave those thoughtful banking decisions to a phone app? How does this make them more competitive with the challenger banks and money-center banks? Call me crazy, but to me, they’re losing a key differentiator. One, in fact, that defines who they are as a community bank. At that point, they’re not competing with the challenger banks… they’ve become one. Then good luck competing.

About Bank Marketing Center

Here at BankMarketingCenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. In short, build your brand.

To view our marketing creative, both print and digital – ranging from product and brand ads to in-branch brochures and signage, visit bankmarketingcenter.com. Or, you can contact me directly by phone at 678-528-6688 or email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.