Facebook. Instagram. YouTube. TikTok. Twitter. You've decided that you're going to add social media to your marketing mix. Now, which platform to choose? While you may feel you need to choose one or two, why not take advantage of them all? As you’ll see, each one is unique, offering its own unique opportunities. If you have any preconceived notions about social media, like "it's just for kids," put those notions aside and read on.

Why social is ideal for community banks

Why? Because social media IS community, which is why it aligns perfectly with community banking. Unlike the large, national banks, community banks are in the business of participating in their communities and, importantly, helping people through relationships. It’s about connecting with customers on a personal level. And that’s what social media is all about.

The most viewed, followed, and shared content on social platforms is the content that is perceived as authentic, the content that shares thoughts and experiences, not information. Here's a brief overview of the social media channels that you, as a financial institution, really need to incorporate into your marketing plan:

TikTok

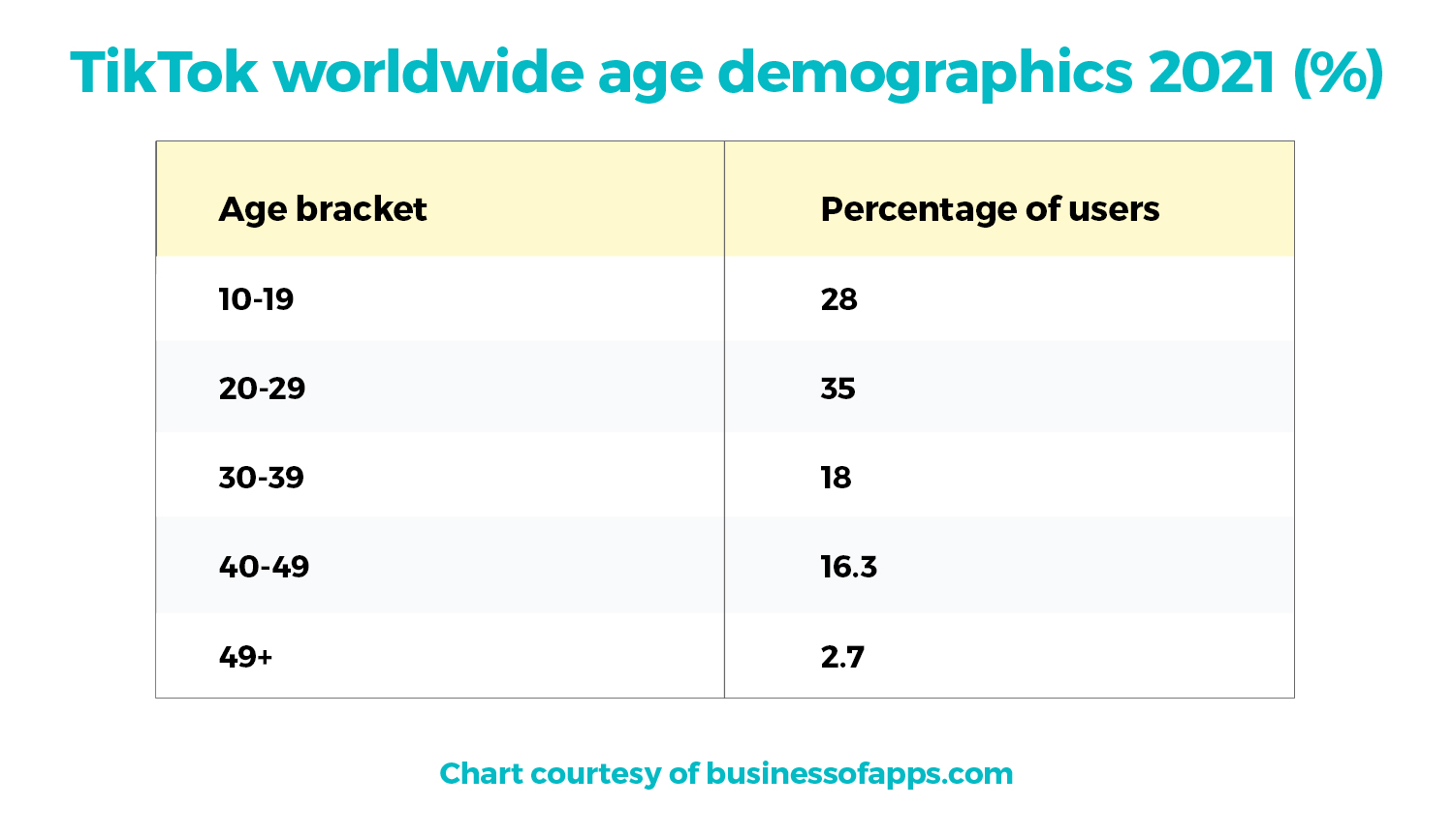

It’s been predicted that by the end of this year, TikTok will boast 1.8 billion active users worldwide. While the largest demographic of TikTok users skews younger, at ages 18-29, it’s not just a fad for Millennials and Gen Zers. The 30-39 demo constitutes nearly 20% of the platform’s user base. Check out this success story from earlier this year: “FNB Community Bank is conquering TikTok.” It chronicles the success that a Midwest, OK-based community bank has had with a platform that just a few years ago, wasn’t even on most marketer’s radars.

“These days,” the article says, “Julie (Julie Waddle, Assistant Vice President, Marketing Manager) creates videos about financial advice, the community bank’s high-quality customer service and even its ugly Christmas sweater contest.” Her recordings can sometimes receive up to several thousand views. “A few of FNB Community Bank’s videos, however,” the article goes on to say, “have garnered tens of thousands of views, reaching far beyond the community bank’s footprint.” To learn more about the benefits that TikTok can help you market your bank, visit TikTok for Business.

Facebook

The oldest and by far the most far-reaching of all social channels, Facebook boasts over 2 billion users around the world. Over the past few years, Facebook has evolved from a GenX channel to a Boomer channel. This platform has gained popularity among businesses not just for its affluent user base, but also for the variety of options it offers, including professional pages, paid post promotion, and native advertising. For financial institutions, Facebook is an ideal channel for reaching an older (55+), affluent market with products such as second home mortgages and retirement vehicles. To learn more about the benefits that Facebook can offer your business, visit Facebook for business.

Twitter

For a long time, Twitter had been known as the platform for Millennials. This is, however, no longer the case. Today, world leaders and Fortune 100 CEOs are tweeting away. For the customers of small businesses, including banks like yours, Twitter is a way to share compliments and complaints (yes, unfortunately!) and for those businesses, an opportunity to quickly respond to customer questions and concerns. Twitter, then, is a great vehicle for:

- solving customer issues

- building relationships that can lead to greater revenue

- learning about what your market thinks of your products and services, and

- promoting new products with the “breaking news” urgency that is unique to this channel.

To make it even easier for businesses, Twitter now offers a series of features geared toward customer service and support, which as Twitter describes them, will enable businesses to “focus on personalized, customer-focused responses in order to provide winning social customer service.” To learn more, visit Twitter Business or follow @TwitterBusiness .

Instagram

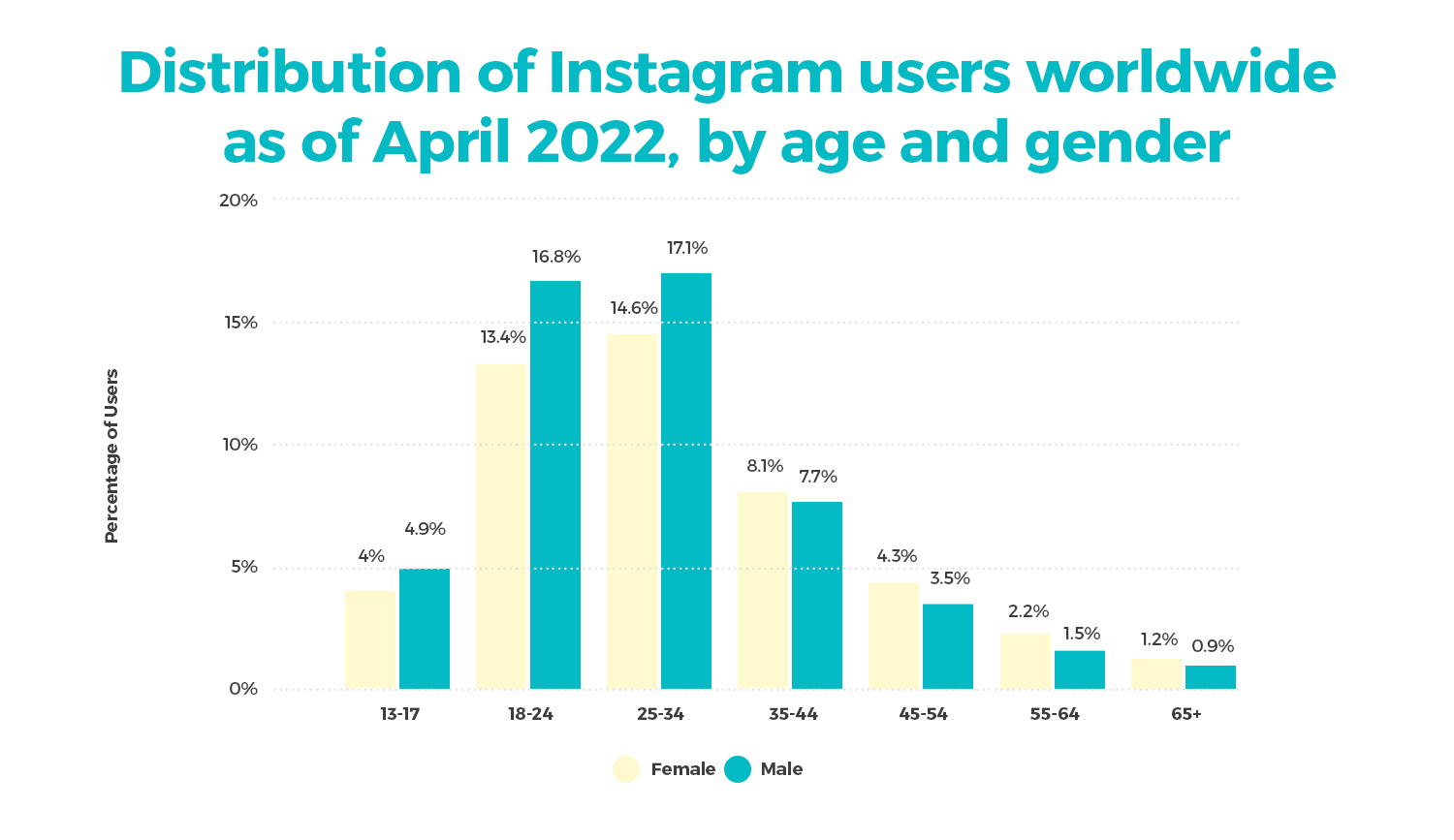

Second only to Facebook, Instagram has a relatively large following; approximately one billion users. As illustrated in the chart below, courtesy of Statista, as of April 2022, 17.1 percent of global active Instagram users were men between the ages of 25 and 34 years. More than half of the global Instagram population worldwide is aged 34 years or younger.

Instagram users are largely Millennials, a desirable market for financial institutions, particularly as they are just now taking interest in financial services. This platform relies heavily on images, both still and video. So what can you do with Instagram?

Think fun, informal, entertaining content. Videos and photos generated by customers and employees, for instance: Birthdays, holidays, work anniversaries, community events... these help position your staff as the caring and trusted advisors they are while building your brand as a community institution at the same time. You can even post short (slightly humorous, perhaps) demo videos on how to download your mobile app or pay bills online. The more imperfect these videos are, the better. The goal here is more about being authentic and engaging and less about being informative. To get started with Instagram, visit Business.Instagram.

YouTube

The second largest social network, and second largest search engine in the world, more than 300 videos are uploaded to YouTube every minute. Almost 5 billion videos are watched on YouTube every day by over 2 billion users. YouTube is an ideal platform for complex products or services such as home mortgages for first-time home buyers, for instance, where you’re perhaps looking to reach a relatively young audience with informational videos that can go in-depth on the benefits of your mortgage products. YouTube also reaches individuals ages 45-64, making it a good vehicle for retirement products. To learn more about what YouTube can do for your bank’s marketing, visit YouTube.com.

All in all, social media channels can be truly effective in growing your financial institution’s revenue. Through these platforms you introduce new products, cross sell, gain valuable insights into customer preferences and market trends, improve your customer service support… the list goes on. Ready to get started? Coming soon; a few tips on how to get the most out of these social media channels as you develop your digital marketing campaign.

About Bank Marketing Center

Here at BankMarketingCenter.com, our goal is to help you with that vital, topical, and compelling communication with customers; messaging developed by banking industry marketing professionals, well trained in the development of effective marketing communication, that will help you build trust, relationships, and revenue. And with them, your brand. Like the below recruitment ads, for instance, recently added to our library of content.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.