I’m one of the lucky few who, at the moment, doesn’t have a car payment. And when I say “few,” I really mean it. Just how many auto loans are out there these days? A lot… 113 million, by recent estimates. To give you an idea of the dollars involved, at the end of the fourth quarter of 2019, TransUnion estimated that Americans were carrying a total of $1.3 trillion in auto loan debt with the average auto borrower carrying a balance of roughly $18,500.

If I were making monthly payments on a car loan that was somewhere between 2 and 5 years old, I’d probably be looking to take advantage of historically low interest rates and refinance that loan right now. If I were a banker, and I was looking to bring new customers to my bank or new members to my credit union, I would probably be looking to use auto refinancing as a way to do that.

Unfortunately, now is the perfect time to market auto loan refinancing. I say unfortunately because there is good news and bad news; together, they are making this a good time to refinance an auto loan. On the one hand – as you can see from the chart below, courtesy of Statista – there’s good news; rates are ideal for an auto loan re-fi right now.

On the other hand, there’s bad news; Americans continue to face uncertain times due to COVID-19. The pandemic has not abated and, as a result, the economy continues to take baby steps toward recovery, with tens of millions of Americans trying to find some kind of economic relief. Saving just $100 each month by reducing their car payment would provide some of that relief.

While no one seems certain about the future of rates, one thing we know that we can all bank on; if you borrowed money a year or so ago to buy a car, you’re very likely paying more than you could be. Which brings me to why financial institutions should be marketing their low-interest auto loans to those who borrowed within the last two to five years. First, as you well know, it’s not easy to get someone to leave their financial institution and take their business elsewhere. Attracting new customers to your institution is hard work, and it can be costly. According to Bain & Company research, acquiring a new customer can cost five times more than retaining an existing customer. ”In financial services, for example,” the study says, “a 5% increase in customer retention produces more than a 25% increase in profit. Why? Return customers tend to buy more from a company over time. As they do, your operating costs to serve them decline. The success rate of selling to an existing customer is 60-70%, while the success rate of selling to a new customer is 5-20%.”

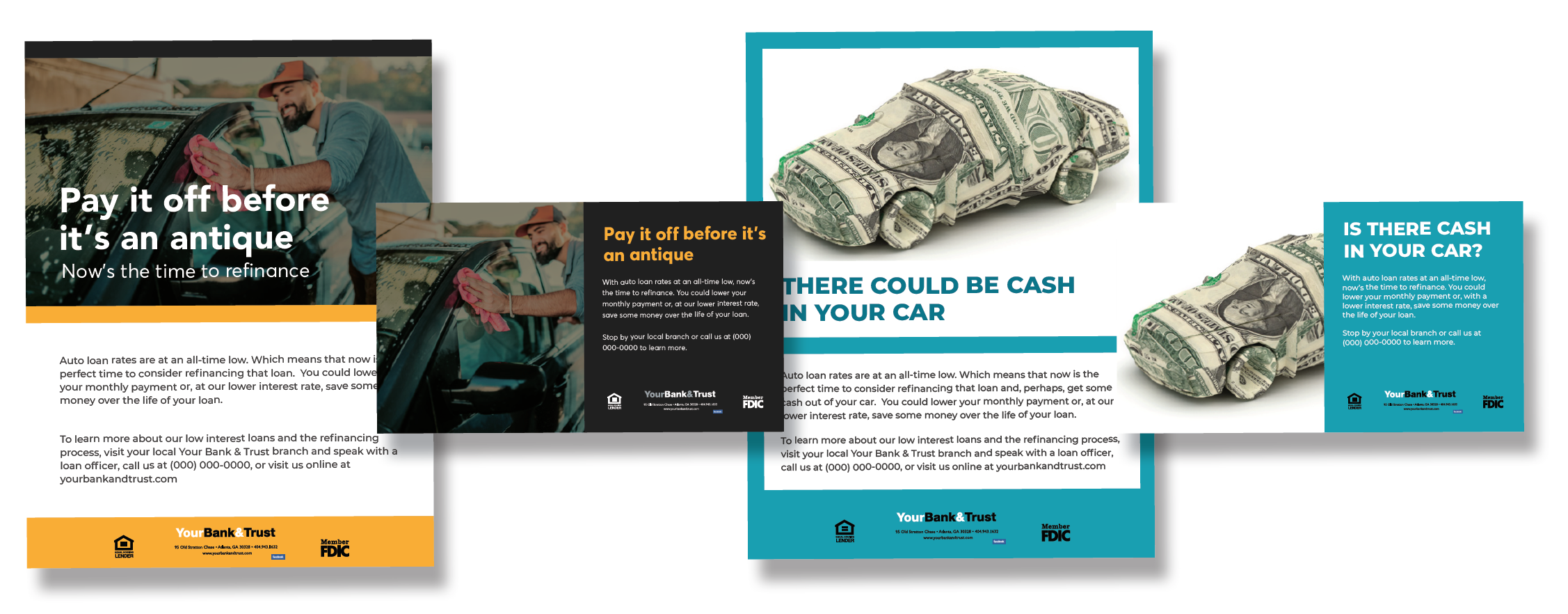

In order to make is easy for banks and credit unions to get their auto loan refinancing message out there, we’ve created a campaign of ads, both print and digital that can be customized quickly and easily.

Now’s the time to attract new customers and members. Borrowers are turning to online lenders such as Lending Tree and Credit Karma for the ease and convenience they offer. But you can offer them something more; not only competitive rates, but the personalized service that can, potentially, help you attract customers and members for life.

About Bank Marketing Center

Here at BankMarketingCenter.com, our goal is to help you with that vital, topical, and compelling communication with customers; messaging that will help you build trust, relationships, and with them, your brand. To view our marketing creative, both print and digital – ranging from product and brand ads to in-branch brochures and signage – visit bankmarketingcenter.com. Or you can contact me directly by phone at 678-528-6688 or email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.