Let me begin by admitting that I found these recent articles both informative and confounding. In the end, however, I believe this is good news for community banks, but I will leave you to be the judge.

The Financial Brand, in “Neobanks’ Growth Comes at a Cost: What it Means for Traditional Banks,” states that “digital-only neobanks as a group have struggled to achieve primary account status.” Citing a Moody’s study, the article goes on to say that “most customers use challengers as a secondary bank account, while their salaries are paid into accounts at incumbent banks.” Other research, however, according to The Financial Brand, “indicates that in the U.S. that may be changing. Cornerstone Advisors found in 2022 that the percentages of the three youngest adult generations — Gen Z, Millennials and Gen X — that consider a digital-only bank their primary checking account provider have jumped sharply.”

This thinking is also supported by a recent article in Forbes, “The growing domination of Chime, Cash App, and Pay Pal in banking,” which states that “more than a quarter of Gen Zers (21 to 26 years old) and nearly a third of Millennials (27 to 41) now call a digital bank their primary checking account provider. Among Gen Xers (42 to 56), the percentage who have their primary account with a digital bank grew from 8% to 22%. Overall, six in 10 Gen Zers and Millennials whose primary checking account is with a digital bank has that account with Chime, PayPal, or Cash App.”

But, wait a minute. There appears to be a bit of a silver lining to this “account-switching” cloud, at least for community banks. That’s because a bit further down in the article, Forbes goes on to say that:

“Community banks are making a comeback.

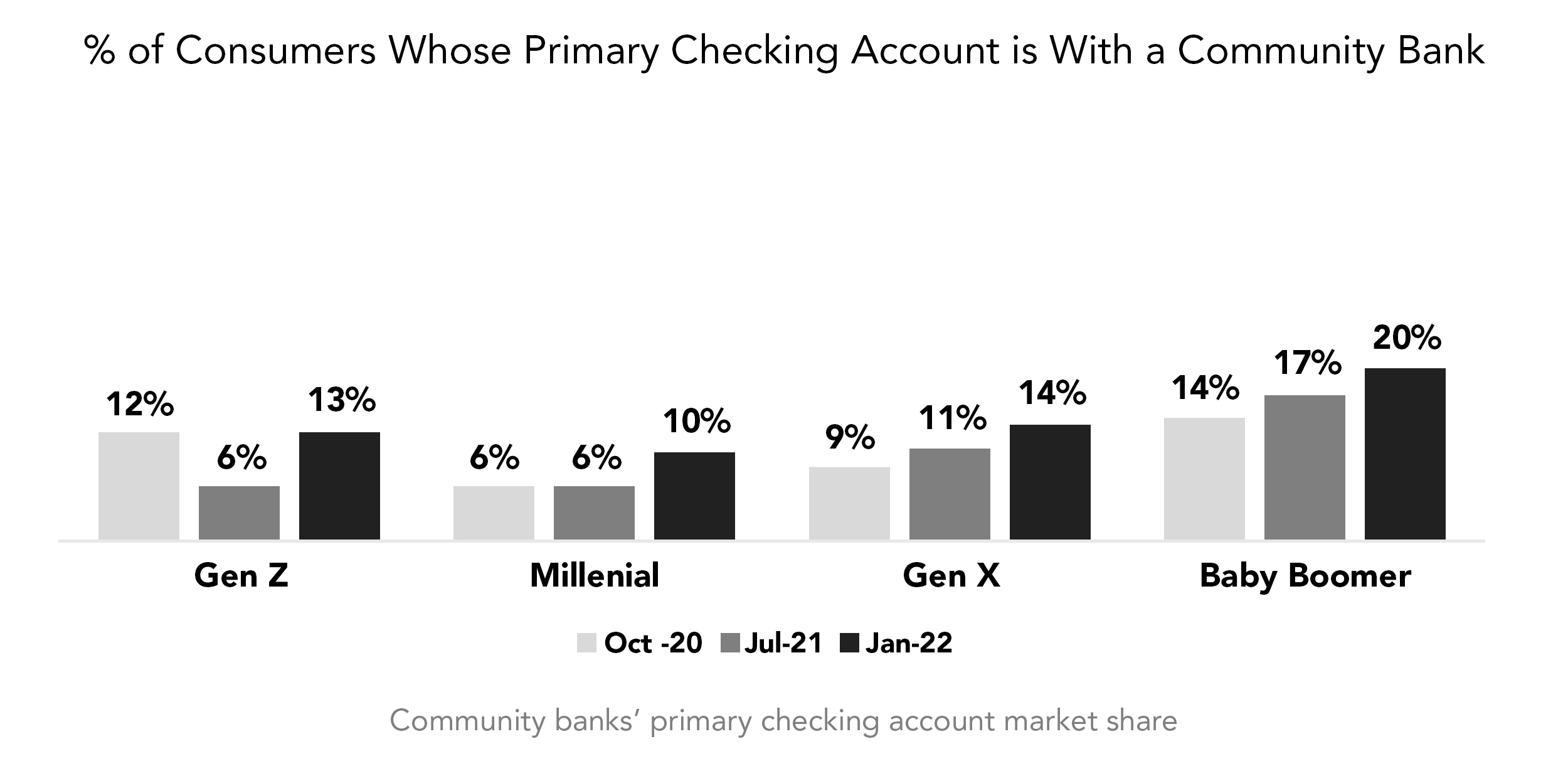

Bucking the trend, community banks gained share in primary checking account status across four generational segments (no, that wasn’t a typo, and yes, I double-checked the numbers).”

Which is great news for community banks, right? Well, not so fast. Because even further down in the Forbes article we learn that, apparently, neobanks don’t offer what we consider a traditional checking account. Instead, they offer what the article refers to as “mashup” accounts. So, I guess the accuracy of all of the above depends on how one defines a “primary checking account.”

So, at this point I’m kind of left wondering; are community banks really “bucking the trend” or not? Whether they are or aren’t, community bankers can at least take some comfort in this piece of good news, found at the very end of the Forbes article:

“Personal relationships still matter. The uptick in primary customer market share for community banks reflects a growing need among some consumers to have the personal touch. According to Charles Potts, Chief Innovation Officer at the Independent Community Bankers of America, “Many consumers need a banker, not just a bank—and the relationship banking model is at the heart of community banking.”

What’s the takeaway from all this? Community bankers, keep doing what you’re doing. Be “the banker, not just the bank.”

About Bank Marketing Center

Here at BankMarketingCenter.com, our goal is to help you with that vital, topical, and compelling communication with customers; messaging developed by banking industry marketing professionals, well trained in the development of effective marketing communication, that will help you build trust, relationships, and revenue. And with them, your brand. To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject.