Like many of you, I’ve been doing a bit of reading on the subject of SMS marketing. It’s a pretty hot topic. After all, at first blush it seems like an absolute no-brainer for financial institutions and for a whole host of reasons. Take this endorsement of it in The Financial Brand’s article, “The Untapped Power of SMS Marketing in Banking”: “When it comes to direct marketing, no channel is more immediate or impactful than SMS marketing. 68% of people say checking, sending, and answering text messages is the activity that they’re most engaged with on their phones throughout the day. In addition, 82% of consumers say they open every text message they receive.” In a more recent article on the subject, The Financial Brand points out that “by not using SMS text messaging for marketing, you are missing a channel with a 98% open rate and a rapid response rate. Consumers love the convenience and are open to receiving personalized and relevant texts from their bank and credit union.”

It is absolutely true that SMS can be a far more effective way to reach consumers than, say, email. And the stats you’ll find out on the web confirm this. MailChimp says that the average email open rate is around 20% with incredibly effective emails earning open rates scoring between 30 and 40%. By contrast, according to podium.com, “with SMS marketing you can take advantage of the only channel with a 98% open rate and campaigns that get immediate responses and measurable results.”

There’s no doubt that when it comes to notifying customers of overdrafts, stolen credit cards, late fees, payment reminders, or suspicious activity, text messaging is a great way to communicate that information to customers, AND a far more effective way to do it than emailing.

But does the above constitute real marketing? I’m just not seeing it. At least, not yet.

Marketing is about delivering value and do notifications deliver value? I suppose they do… to a small extent. But true marketing messaging touches on much more; it’s about the why, not the what. Sure, an SMS notification that tells me that a payment is due, or that my credit card is being used by someone at a car dealership halfway across the country, is indeed helpful. But I hardly consider these “personalized” messages, even though they pertain to me and only me. Simply because I’m the only one receiving the message doesn’t mean that it's personalized… at least not in the marketing sense. Where is the emotional connection, which we all know is so critical to effective marketing messaging?

We had a bit of fun with this a while back in a blog about marketing messaging and personalization. The point, at the time, was to drive home just what personalized SMS marketing can be. We talked about a young couple simply relaxing at home when the young man begins receiving a series of SMS messages from their bank. The messages are fairly innocuous at first, but become progressively more disconcerting. The first text seems ordinary enough: “We hope you’re enjoying the new truck you purchased with one of our auto loans.” When it’s followed shortly afterward by, “we’ve noticed that you made a large purchase at the grocery store just the other day… having a party?” the couple gets a bit concerned. By the last, they’re totally creeped out: “We have the loan you need when you’re ready to decorate that baby room. Congratulations.” Thanks to personalization, the bank knows they're expecting... even before they do.

A bit of hyperbole, for sure, but you get the point. Personalized messaging must “strike a chord,” as well as a balance between being informative and being invasive. But it must certainly do more than simply inform. In order to develop that messaging, one needs data; info on the consumer’s buyer journey; the who, what, when, where, why, and how of their brand experience. And the technology can enable the harvesting of that kind of customer data is out there.

Utilizing AI-driven data management tools, a bank has a real opportunity to truly use SMS as a marketing tool. That’s because AI can automatically analyze huge volumes of consumer data and identify user trends and behaviors. Rather than targeting individuals based simply on age and gender, AI gives you the ability to more accurately identify their behaviors and purchase patterns. For example, monitoring an individual’s use of products and services, AI can help predict a future purchase.

Now, with the help of AI, you can deliver a relevant, compelling, and highly personalized message to an individual just at the right moment in their path to purchase. A great way to deliver that message? You guessed it. SMS.

About Bank Marketing Center

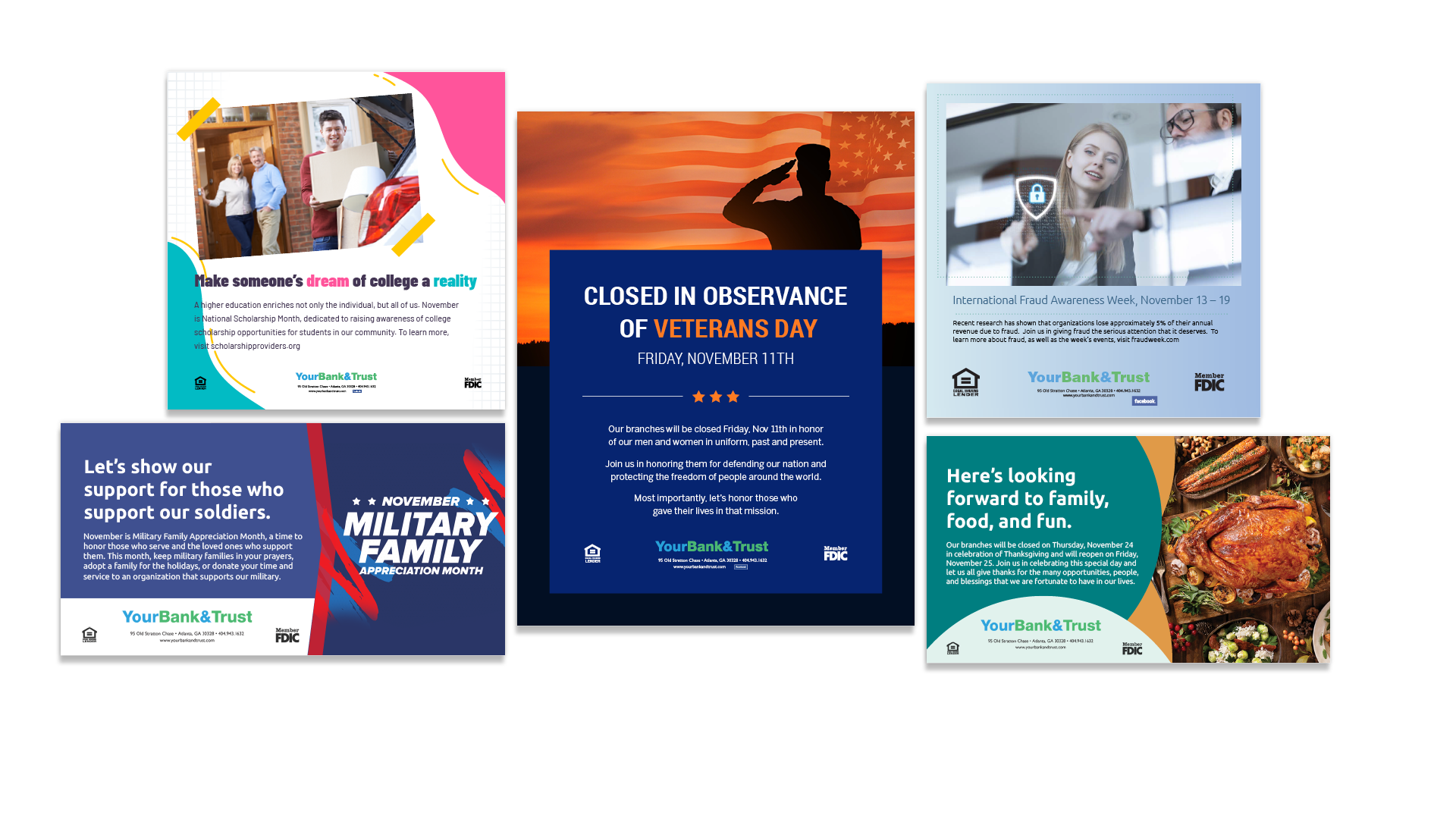

Here at BankMarketingCenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. In short, build your brand. Like these November observances, for instance, which you'll find in our portal and will help you get the message out to your customers quickly and easily. To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject #bankmarketing #communitybankmarketing #smsmarketing

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject #bankmarketing #communitybankmarketing #smsmarketing