‘Tis the season, isn’t it? So, what does this holiday season hold for consumers? From here, it seems like there’s a perfect holiday season storm brewing… that is, not a lot of comfort and joy. I consider myself an optimist, but this holiday is going to present a confluence of challenges: an impending financial crisis (according to some, anyway) in early 2023, mounting consumer debt ($16.5 trillion this year versus $13.8 in 2019), rising interest rates (prime rate of 6.25%, nearly double from this past March), fraudulent activity like we’ve never seen before (1.4 million cases of identity theft have been reported to the FTC thus far this year)… hmmm, what else? Oh, an overwhelming consumer desire to spread holiday cheer with gift giving that they truly cannot afford. What’s a community bank to do?

I read these words of wisdom in a recent article posted by The Financial Brand: “Associating a financial institution’s values with consumers’ values is always good practice — and the holidays activate people’s value systems like nothing else. It pays to remember, however, that one of those values is frugality. In 2022, many bank customers and credit union members are shopping in a state of financial anxiety. Easing their fears — and starting early — with cost- and credit-sensitive products may be the most valuable thing a marketing strategy can do during the holidays.”

So, again, what is a community bank to do? In terms of marketing — and, of course, that’s always the lens through which I view everything — I’m reminded of the holiday film, Miracle on 34th Street and the Macy’s/Gimbel’s strategy. If I recall, in a nutshell, that strategy was centered on the belief that goodwill (especially when folks are thinking “goodwill toward men”) is the most effective kind of brand marketing.

I’m not saying that you should go out and actively tell your customers that they’d be better served by another bank. What I am saying is — and this is a basic tenet of marketing, right? — that you should consider a short-term sacrifice (if it comes to that) in order to realize a long-term gain. Sure, sometimes marketing is about taking the short view, i.e., product promotions, but by and large it is, or at least it should be, about the long game.

Yes, you could market, as The Financial Brand article suggests, your “cost- and credit-sensitive products.” Not a bad idea, I think. But I think I might take it even a step further. As we approach the holiday season, which is right about now, don’t market products. Instead, market your concern about your customers’ financial well-being. After all, isn’t the empathy on the part of community bankers what separates community banks from neo-banks and the big nationals?

Instead of pushing those cost- and credit-sensitive products, why not encourage your customers to take the long view and “shop responsibly”? Use cash only, for instance, instead of adding more to an already burdensome credit card bill. Research shows that we Americans spend a lot of money at holiday time, and often add to our debt in the process. According to the latest data from the National Retail Federation (NRF), holiday sales will total $1.45 to $1.47 trillion during the November through January timeframe. It also shows that American consumers spend an average of $997.73 on gifts and holiday items each Christmas; nearly two car payments for the average American. 13% spent $3000 or more. And when many don’t have $400 set aside for an emergency, $1000 is a pretty big chunk of change. A just-released MoneyGeek survey reveals that over a quarter of Americans are currently living with regret over their last year’s holiday spending and are still paying off 2021 holiday debts. 65% of them used credit cards.

Based on what we know of the past, we can be pretty sure that many Americans will be buying on credit; perhaps going the BNPL route, figuring that making four “easy” payments is better than plunking down the entire amount at once on each of their purchases. Or, telling themselves that when that first credit card bill comes that they’ll pay the entire amount. Not a good idea. With a tough 2023 heading our way, now is the time to market goodwill instead of products and really help your customers manage their financial futures. While you may not sell them on a new credit card, loan, or HELOC, for instance, you’ll sell them on something much more important: Your brand. And there is no putting a price on that

As a final thought, what can we all do this holiday as an alternative to over-spending on holiday gifts? Spend some time helping those in the community who are less fortunate than we are.

About Bank Marketing Center

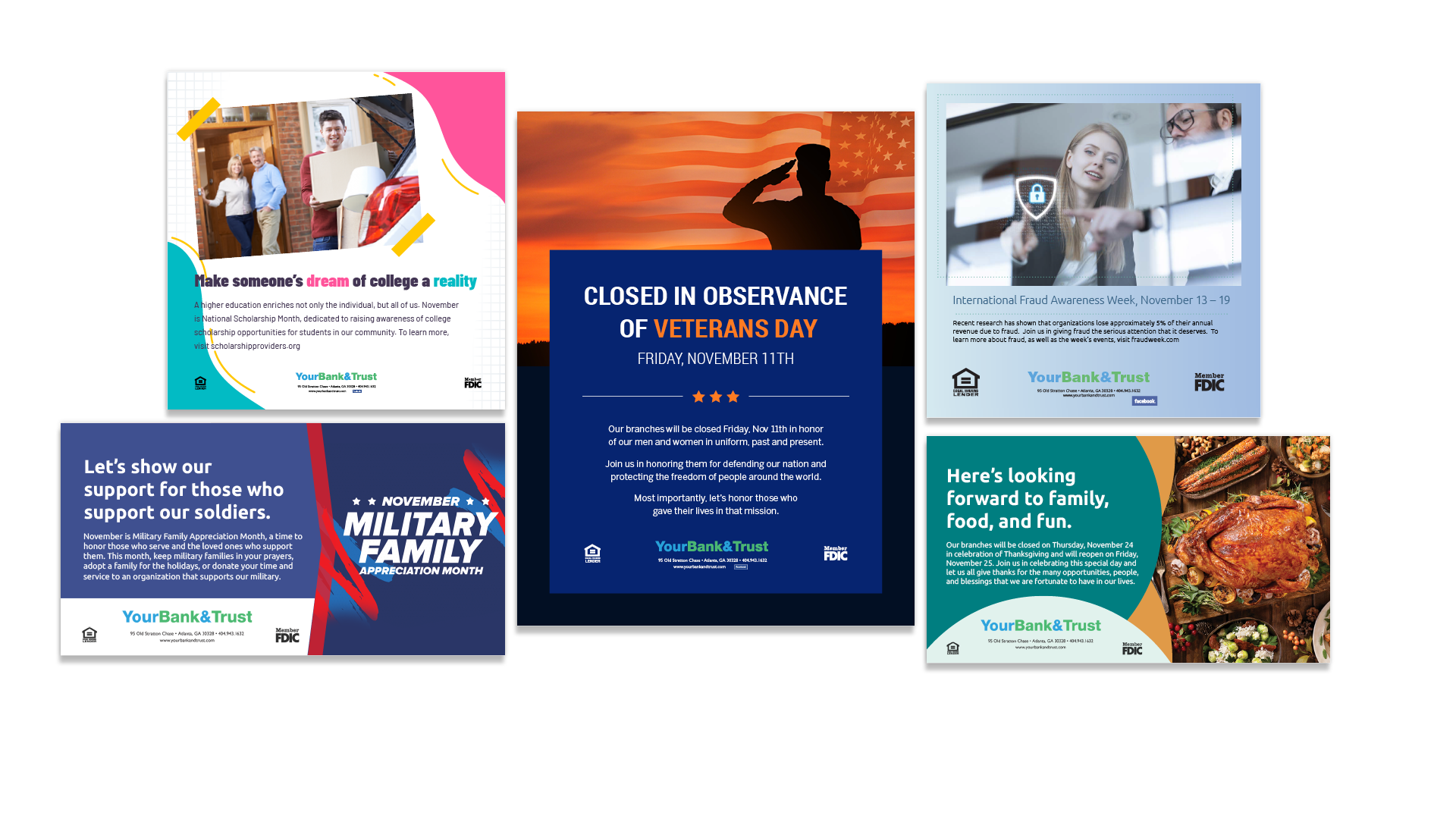

Here at BankMarketingCenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. In short, build your brand. Like these November observances, for instance, which you'll find in our portal and will help you get the message out to your customers quickly and easily.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject. #bankmarketing #communitybankmarketing

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I would love to hear your thoughts on this subject. #bankmarketing #communitybankmarketing