.jpg)

Geofencing, a location-based marketing strategy, is emerging as a powerful tool that not only connects you with your customers but also enhances their overall experience of your brand, products and services. And while geofencing has actually been around since the early 1990’s, the popularity of smartphones and mobile devices has now made it an incredibly valuable marketing tool for businesses… like your community bank.

Geofencing offers a world of possibilities. Unbelievable as it sounds, geofencing can even enable you to build a “fence” around another bank. When a prospect is inside that fence, they can receive a notification that you offer credit cards with the lowest interest rates in the area. Let’s take a deeper look at the benefits of geofencing and how your community bank can put it to good use.

How does it work?

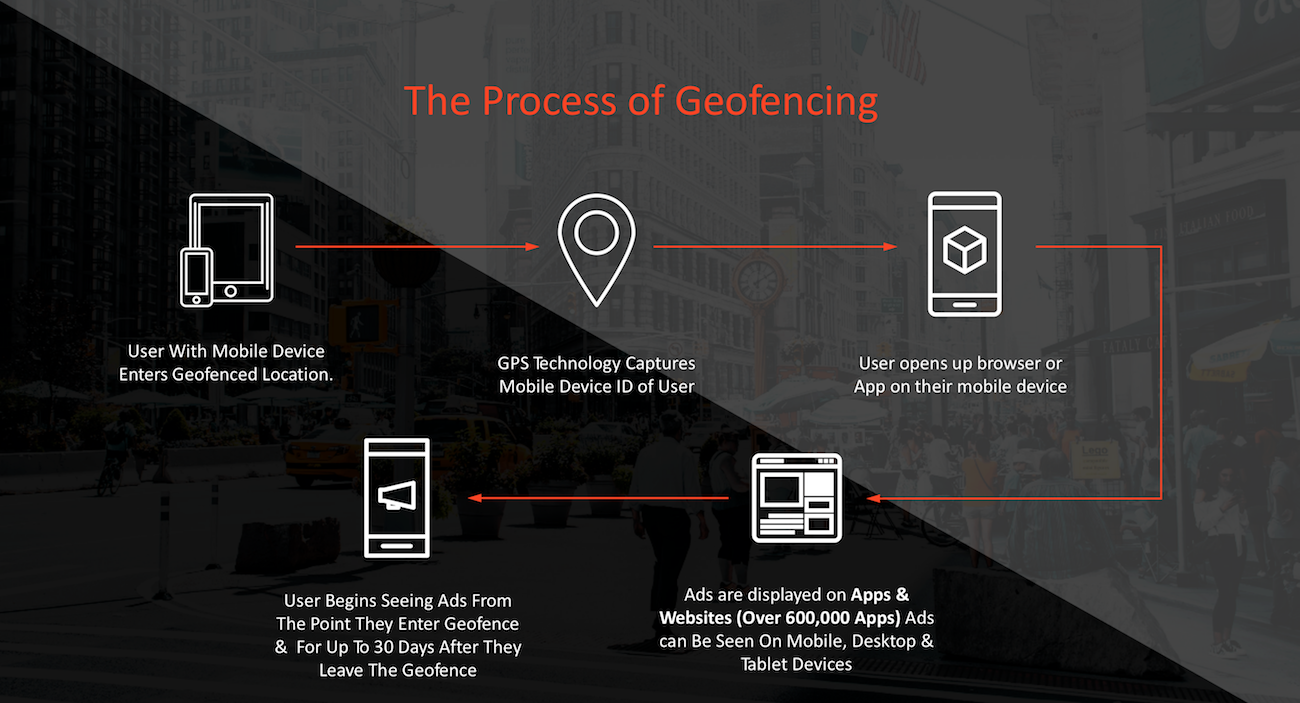

Geofencing uses IP addresses, Global Positioning System (GPS), Radio Frequency Identification (RFID), Wi-Fi, or cellular data in order to define “virtual boundaries” around physical locations. These virtual perimeters allow marketers to send targeted messages, notifications, and offers to users' devices when they enter, exit, or dwell within that predefined, “fenced” area. Think of it as literally connecting the online and offline worlds, enabling businesses to deliver timely and relevant content to consumers based on their physical location. (Image below courtesy of Propellant Media)

Personalization Redefined

One of the most significant advantages of geofencing lies in its ability to deliver hyper-personalized content to consumers. By leveraging its ability to collect personal data, you can tailor your messages to match a potential consumers' immediate surroundings and preferences. With it, you now have insights into the demographics of the local population, including what kind of offers, or news, might interest them. For instance, say Valentine’s Day is just around the corner. Using geofencing, you can build a geofence around your ATMs, then send a push notification reminding your target audience that should they decide to make a Valentine’s Day purchase, there’s an ATM conveniently located in their area, (maybe even “within a short walk from where you are right now!). Another example? Build a geofence around area car dealerships if you are looking to make auto loans.

This personalized approach not only boosts the chances of engagement but also enhances the customer's perception of your bank’s brand. According to a study conducted by SmarterHQ, 72% of consumers admitted to only engaging with marketing messages that are personalized to their interests. Geofencing takes personalization a step further by aligning messages with consumers' physical location, making the content even more relevant and appealing.

Enhancing Customer Engagement and Loyalty

Geofencing enables you to engage your customers at the right place, at the right time, and with the right message. By offering location-specific promotions, recommendations, or event notifications, your bank can foster an even deeper connection with your customers, building greater trust and with it, loyalty. You see, not all of your messages need to be intended to sell products. For instance, you can target attendees at a local community event – such as a breast cancer fundraiser – and reach out to them with a message that says you appreciate their support and that your bank is a supporter, too.

Furthermore, geofencing can be integrated with loyalty programs. When customers receive rewards or incentives upon entering one of your retail branches within a geofenced area, they are more likely to return. This combination of personalization, immediate gratification, and incentives contributes to higher customer retention rates and long-term loyalty.

Real-Time Analytics and Data Insights

In addition to its customer-facing benefits, geofencing provides valuable data insights and analytics. Knowing just what brought a new customer can be hard to measure. What brought that customer into your branch? If you don’t have the chance to survey every customer who walks through your door – and you probably don’t – it can be difficult to connect an in-branch visit to your online efforts. However, if customers are coming in with your promotions from geofencing, there are a number of metrics you can measure, including sales, how long they are in your store, and how often they visit. All of this can be valuable information that adds depth to your analytics and with that, more effective marketing across the board.

As Shakespeare said: “Know thy customer!”

Before you begin marketing with geofencing, make sure you understand customer demographics and who your local customers actually are. This helps ensure that the promotions you use are, in fact, the ones that are going to be most successful and get the kind of results you want.

Keep it Close

You do not want to have your geofencing area too large. In fact, according to Salesforce, “the general rule is a four-to-five minute travel radius. If you are in a city where most people walk from point A to point B, then this means you want to keep it a four-to-five minute walking radius; alternatively, if most people drive, a four-to-five minute transport distance is the maximum to be successful.”

Challenges and Considerations

While geofencing offers numerous benefits, there are potential challenges and concerns associated with its use. Privacy is a primary concern, as users might be wary of sharing their location data and personal information. The California Consumer Protection Act (CCPA), for example, details common rights for consumers:

- The right to request disclosure about what information is being gathered and what purpose it is being used for

- Limitations on the use of information only for its expressed purpose

- The right to access information gathered

- The ability to opt-out

Your provider should ensure that you are being transparent about your data usage policies and are in compliance with any regulatory requirements. Your provider should also manage obtaining user consent before engaging in geofencing activities.

Give it a try

Geofencing has evolved into a game-changing marketing strategy that empowers businesses to connect with consumers in innovative ways. From delivering hyper-personalized content to driving impulse purchases and enhancing customer engagement, geofencing offers a range of benefits that contribute to improved brand perception, customer loyalty, and bottom-line results. By harnessing the potential of geofencing while being mindful of privacy concerns, your community bank can build brand, loyalty and revenue. Now, if you’re interested in moving forward, I will say that there are a number of companies that can partner with you in implementing this platform. I found this G2 site helpful; it points out the pros and cons of some of the more popular geofencing providers.

About Bank Marketing Center

Here at bankmarketingcenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts.