Sustainability. To most, the word connotes “going green” by choosing paper over plastic, recycling rather than committing trash to a landfill, or driving fewer miles. In other words, modifying consumption behaviors to reduce the human carbon footprint on our shared earth. For financial institutions, that notion of sustainability barely scratches the surface. Granted, sustainable business practices have always played a role in banking operations and profitability (as well as bank marketing) but, today, those practices are even more vital. Why?

With growing pressure from employees, the federal government, a wide range of both state and federal regulatory agencies – and importantly, customers – it has become more critical than ever for banks to have a strategy in place for addressing what is known as the “Triple Bottom Line” (TBL) – people, planet, and profit - in their bank marketing.

Originating in 1994, the TBL initially encapsulated social equity, economic, and environmental factors. However, over time, this concept has evolved into broader frameworks like CSR (Corporate Social Responsibility), ESG (Environmental, Social, and Governance), and specialized concepts such as environmental P&L, impact investment, and carbon productivity.

Why sustainability is critical to bank marketing

According to a recent survey by Mambu, a financial services technology company, “findings demonstrate the sustainability opportunity for banks, as nearly half (49 per cent) of consumers say they would consider switching to a provider with a stronger commitment to sustainability. And, just two in five (42 per cent) consumers think that their current bank or financial institution clearly communicates its sustainability commitments, with only 37 per cent knowing what climate pledges they have publicly announced or committed to.”

So, what does sustainability mean for community banks? Those banks that fail to value their ESG commitment may find themselves at a reputational disadvantage. And with it, a challenge to their goal of attracting and retaining customers. Simply put, there’s a new kind of customer out there. Today’s banking customer wants to know that their purchases are having an impact—and they’re willing to spend time researching a bank’s products, its social structure and environmental impact. Ergo, the better your community bank can present its commitment to sustainability—that is, to creating economic, social and environmental value—the more success it will have in attracting customers and creating long-lasting relationships with them. Now is the time, if you haven’t done so already, to make and market green initiatives in the marketplace. Switch to motion-sensor LED lighting in your branch locations, eliminate paper where possible (i.e., monthly statements), make use of remanufactured materials and energy efficient equipment where possible. Want more ideas? To discover more ways to go green, visit the Green Business Benchmark website.

How do you develop and reinforce those customer relationships? Yes, you should go green yourself and market that “feature” of your bank, but you can (and should) also encourage your customers to do the same. Create informative content, such as blog posts, videos, and infographics, highlighting the significance of sustainable practices and their positive environmental impact. Share practical suggestions with your customers on how sustainability can integrate into their daily lives, from conscious consumption to energy conservation and recycling. You can even involve them in the processes by asking for suggestions in controlled environments or organizing sustainability-focused events, seminars, or webinars to actively engage your audience. “By positioning yourself as a reliable source of information, you establish credibility and attract sustainable customers who prioritize sustainability in their lifestyles.”1

In conclusion, sustainability in banking is not just a buzzword—it's a transformative journey shaping the future of banking as “greenness” takes on increasing importance to consumers and with it, the bottom line for your community bank.

About Bank Marketing Center

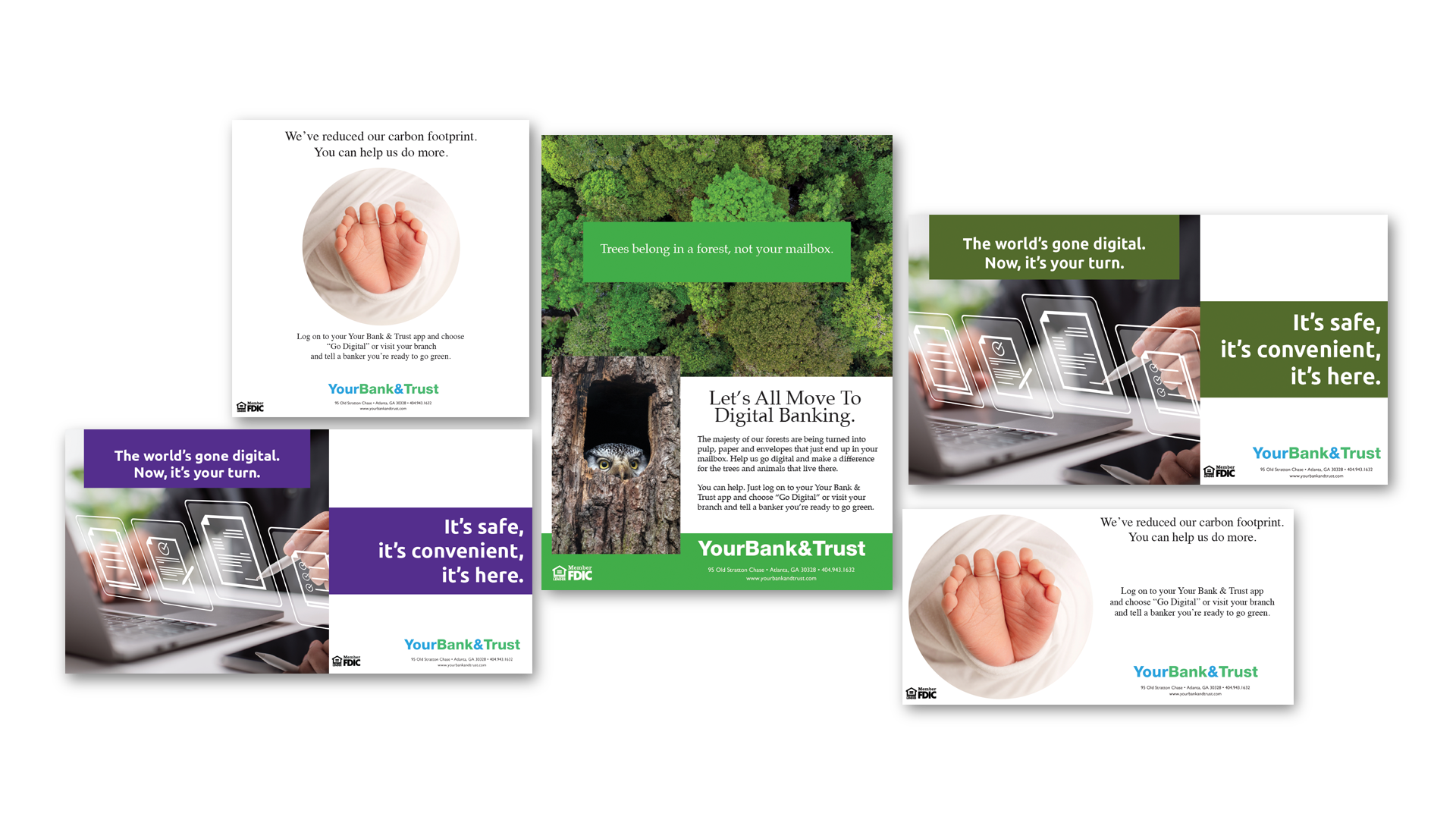

Here at bankmarketingcenter.com – one of the industry’s most well-regarded providers of professionally-designed bank marketing materials – our goal is to help you with that topical, compelling communication with customers that will help you build trust, relationships, and revenue. Like these ads on our portal that you can use to market your sustainability.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts.

1medium.com. How to Attract Customers with Sustainability: Building a Greener Future. October 11, 2023.