It’s that time of year again. BTS (Back to School). Or, when it comes to bank marketing and the Gen Z consumer, what’s commonly known as BTC, or Back to College.

Seems like it was just the other day that we were talking about the Gen Z consumer. Why so much hype about this individual? Because he/she is an important, and somewhat unique, consumer. And, why is this an important time of year, not just for students off to college, but for community bankers, as well? Because BTC is a great time to build upon your base of loyal customers and with it, their CLV or Customer Lifetime Value.

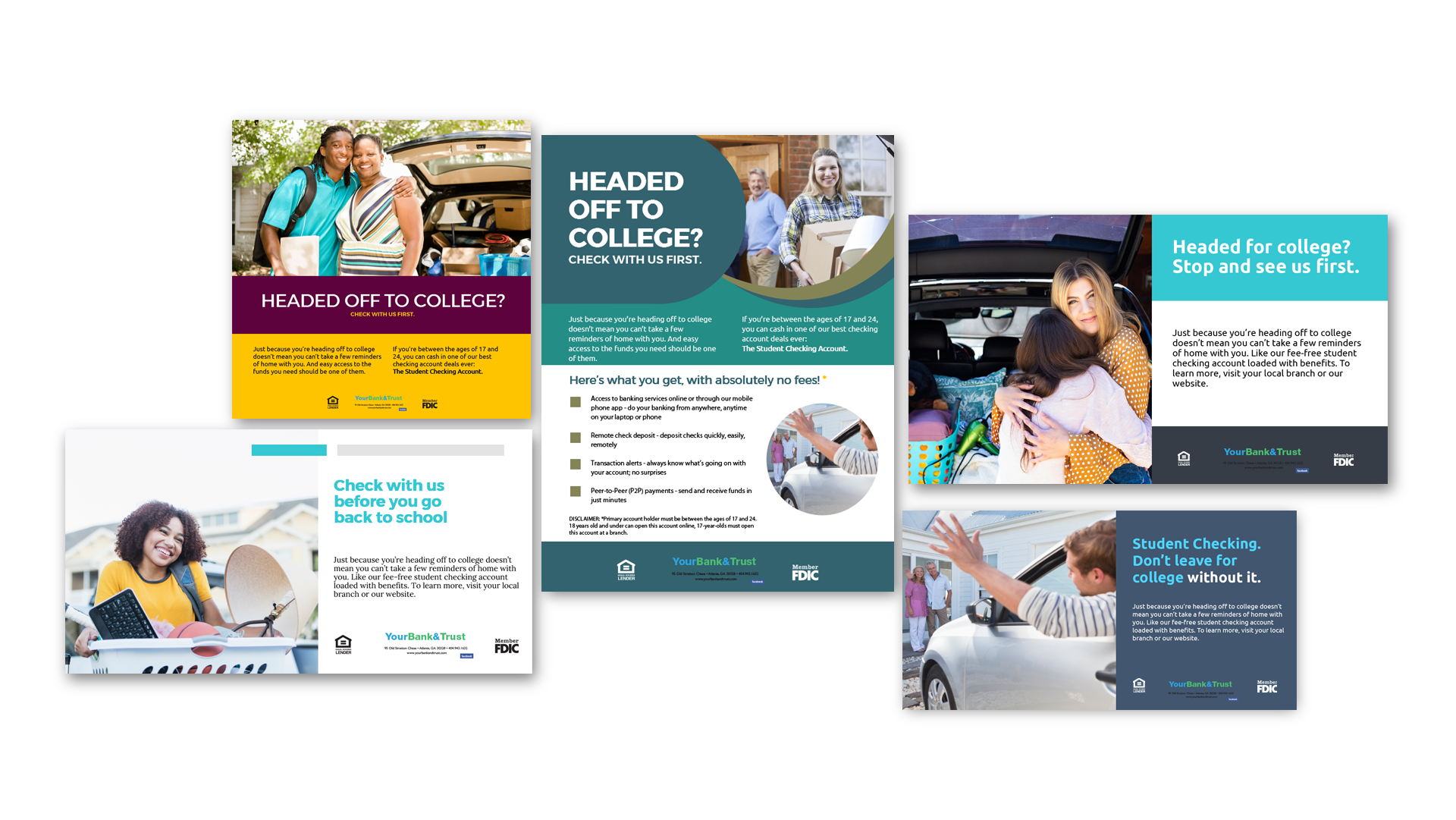

Loyalty. As marketers, this is our Holy Grail. Gen Z individuals, like any other customers, value a trustworthy relationship with their banking partner and for many, college marks a pivotal stage of life where many beliefs and habits, including financial habits, are established. Effectively meeting a college students' unique financial needs provides you with the opportunity to forge a long-lasting relationship. By offering tailored products and services such as student checking accounts (see our campaigns below), you can demonstrate your commitment to their financial well-being, and earn yourself a customer whose need for financial products will only continue to grow. After all, as these young consumers transition from college to the workforce, their financial needs will evolve; it won’t be long before they need products and services such as auto loans, home mortgages, investment options, and retirement planning.

Let's not forget, too, that this is a powerful (numbering nearly 70 million) and lucrative demographic. And yet, while their financial needs are much the same as previous generations, their view of banking services and communication/info gathering is vastly different.

Remember the days when brands used to advertise via mass media? For me, it was a Golden Age. The agency Copywriters and Art Directors would work as teams, putting their heads together with the goal of coming up with that winning :30 television concept. Once an idea for a commercial was hatched, (for me, it could very well be Oscar Meyer), it was storyboarded, presented to the client, tested, modified, tested again, and then – probably a couple of months later, with several internal departments and third-party resources contributing along the way – air on national television. Did we know if the messaging was effective? For the most part, no. If there was a bump in sales, the campaign was considered a success. Now, just how much of a “bump” differentiated success from failure, I’m not sure many at the agency knew… or cared. The commercial aired, it was fun getting it there, and now it was time to move onto the next one. Looking back, yes, it was a blend of art and science… but, a lot of art, and not a whole lot of science.

Today, the crafting of a marketing message is, as we all know, quite different; the opposite, in fact. It’s almost all science, with some art sprinkled in. Consumer touchpoint opportunities have expanded from network television, outdoor, print, and radio – along with mass media messaging – to a laser-focused, personalized omnichannel experience that is dominated by social media and highly-targeted marketing messages. This messaging is continually monitored, analyzed, and “tweaked” when necessary in a continuous feedback loop that, ideally, hones the messaging to perfection as it travels along a very thoughtfully-crafted buyer journey.

As we’ve talked about before, Gen Z is often referred to as the "digital-first" generation, with an inherent appreciation for… no, it goes deeper than that… I would say “reliance upon” social media messaging. As I mentioned a month or so back in a Gen Z blog, reach them where they like to be; Tik Tok, Snapchat, Twitter, and now, Threads. Make sure that these platforms are an integral part of your social media marketing strategy. These platforms offer unparalleled speed to market, effectiveness measurement, and the ability to adjust messaging “on the fly” based on metrics such as likes, follows, and engagement. They also provide you with the opportunity to lead a prospect down a path to purchase. Post some Student Checking ads on your social channels with a link to an online account application, for instance. Perhaps that student needs a credit card, as well. And, if that online application experience meets expectations, your new customer may very well share that information with friends. If that visitor to your site for some reason decides to bounce off, use Google Ads remarketing to keep your message top of mind. If you recall, with Google Ads remarketing, past visitors to your online application will see your ads while they are browsing the web, watching YouTube videos, or reading news sites, for example—and entice them to revisit your site.

In the end…

Securing Gen Z as long-term customers is critical to maintaining a competitive edge and growing your share of wallet. By understanding and catering to the unique preferences of this digitally native generation, and making use of the targeted messaging that social media marketing offers, you can be extremely effective (and hopefully, successful) in promoting the products that matter to them… right at the moment that they matter most.

About Bank Marketing Center

Here at bankmarketingcenter.com, our goal is to help you with that topical, compelling communication with customers; the messaging — developed by banking industry marketing professionals, well trained in the thinking behind effective marketing communication — that will help you build trust, relationships, and revenue. Like these campaigns that can help you attract young consumers who are heading off to college and in need of banking services. To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts.

To view our marketing creative, both print and digital – ranging from product and brand ads to social media and in branch signage – visit bankmarketingcenter.com. You can also contact me directly by phone at 678-528-6688 or via email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts.